how much does gucci cost in china | Gucci cheap real how much does gucci cost in china The market for luxury goods in China composes a significant proportion of all luxury goods sales worldwide. In 2012, China surpassed Japan as the world's largest luxury market. According to a report by McKinsey in 2019, Chinese consumers are the engine of worldwide growth in luxury spending According to a report by Bain in 2021, China's luxury spending is expected to reach more than half the global market value of luxury goods by 2025. This rapid growth has been explaine. FEL-O-GUARD™PLUS 3 + Lv-K Elanco US Feline Leukemia-Rhinotracheitis-Calici-Panleukopenia Vaccine Modified Live & Killed Virus For use in animals only This product has been shown to be effective for the subcutaneous vaccination of healthy cats, eight weeks of age or older, against feline leukemia, rhinotracheitis, calici and panleukopenia .

0 · real Gucci clothes for cheap

1 · discount authentic Gucci

2 · cheap wholesale Gucci clothing China

3 · cheap Gucci boots from China

4 · authentic cheap Gucci

5 · authentic Gucci outlet online

6 · Gucci cheap real

7 · $30 cheap China Gucci shoes

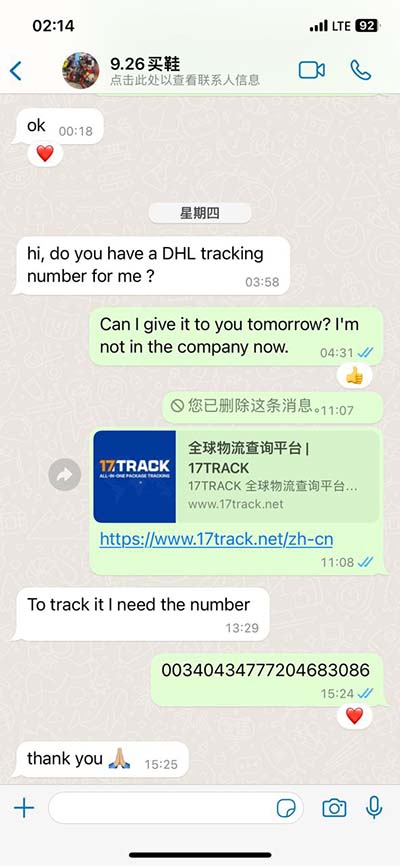

Buy and Sell Authentic Louis Vuitton x NBA Cashmere Felpa Zip Through Hoodie Grey (FW20) Streetwear at KLEKT. All Items Personally Authenticated by Experts, Express Worldwide Shipping Available!

Now, Trump has said he plans to impose a 60% tax on goods from China and a 10% to 20% levy on all of the trillion in foreign goods the U.S. imports annually.The market for luxury goods in China composes a significant proportion of all luxury goods sales worldwide. In 2012, China surpassed Japan as the world's largest luxury market. According to a report by McKinsey in 2019, Chinese consumers are the engine of worldwide growth in luxury spending According to a report by Bain in 2021, China's luxury spending is expected to reach more than half the global market value of luxury goods by 2025. This rapid growth has been explaine.

The Tax Foundation says a 10% universal tariff would increase taxes on U.S. . And he has threatened tariffs of 100, 200 or even 1,000 percent on Mexico, saying . The US heavily taxed imports for much of its history before largely abandoning the . The Peterson Institute has estimated such a plan would cost U.S. families .

Her campaign has cited a report that found that Trump’s 20% universal tariff . The tariff, effectively a tax on the laptop purchase, is 0 regardless of who the .

Economic experts say the cost of the tariffs is expected to be passed . Trump . Trump’s tariff plans would cost a typical U.S. household between ,700 and . Now, Trump has said he plans to impose a 60% tax on goods from China and a 10% to 20% levy on all of the trillion in foreign goods the U.S. imports annually.The market for luxury goods in China composes a significant proportion of all luxury goods sales worldwide. [1] In 2012, China surpassed Japan as the world's largest luxury market. [2] According to a report by McKinsey in 2019, Chinese consumers are the engine of worldwide growth in luxury spending [3] According to a report by Bain in 2021, China's luxury spending is expected to .

The Tax Foundation says a 10% universal tariff would increase taxes on U.S. households by ,253 on average in 2025, and a 20% universal tariff would bump costs by ,045. Financial experts say a . And he has threatened tariffs of 100, 200 or even 1,000 percent on Mexico, saying the country should do more to stop flows of migrants and shipments of Chinese cars.

The US heavily taxed imports for much of its history before largely abandoning the policy, beginning in the 1930s, as government leaders embraced the idea of free trade. High tariffs made a . The Peterson Institute has estimated such a plan would cost U.S. families between ,700 and ,600 per year, and shift the tax burden disproportionately onto lower income consumers. Her campaign has cited a report that found that Trump’s 20% universal tariff would cost a typical family nearly ,000 a year. But the Biden-Harris administration itself has a taste for tariffs. It retained the taxes Trump imposed on 0 billion in Chinese goods. And it imposed a 100% tariff on Chinese electric vehicles.

The tariff, effectively a tax on the laptop purchase, is 0 regardless of who the purchaser is. If a college student making ,000 per year purchases the laptop, the tariff will constitute 2% .

Economic experts say the cost of the tariffs is expected to be passed . Trump pledged to slap 60% tariffs on all goods coming in from China and 10% tariffs on goods imported from all other . Trump’s tariff plans would cost a typical U.S. household between ,700 and ,600 per year, depending upon whether his universal import fee was set at 10 percent or 20 percent, according to an . Now, Trump has said he plans to impose a 60% tax on goods from China and a 10% to 20% levy on all of the trillion in foreign goods the U.S. imports annually.

The market for luxury goods in China composes a significant proportion of all luxury goods sales worldwide. [1] In 2012, China surpassed Japan as the world's largest luxury market. [2] According to a report by McKinsey in 2019, Chinese consumers are the engine of worldwide growth in luxury spending [3] According to a report by Bain in 2021, China's luxury spending is expected to . The Tax Foundation says a 10% universal tariff would increase taxes on U.S. households by ,253 on average in 2025, and a 20% universal tariff would bump costs by ,045. Financial experts say a . And he has threatened tariffs of 100, 200 or even 1,000 percent on Mexico, saying the country should do more to stop flows of migrants and shipments of Chinese cars.

The US heavily taxed imports for much of its history before largely abandoning the policy, beginning in the 1930s, as government leaders embraced the idea of free trade. High tariffs made a . The Peterson Institute has estimated such a plan would cost U.S. families between ,700 and ,600 per year, and shift the tax burden disproportionately onto lower income consumers.

Her campaign has cited a report that found that Trump’s 20% universal tariff would cost a typical family nearly ,000 a year. But the Biden-Harris administration itself has a taste for tariffs. It retained the taxes Trump imposed on 0 billion in Chinese goods. And it imposed a 100% tariff on Chinese electric vehicles. The tariff, effectively a tax on the laptop purchase, is 0 regardless of who the purchaser is. If a college student making ,000 per year purchases the laptop, the tariff will constitute 2% . Economic experts say the cost of the tariffs is expected to be passed . Trump pledged to slap 60% tariffs on all goods coming in from China and 10% tariffs on goods imported from all other .

real Gucci clothes for cheap

michael kors watc

For intramuscular or subcutaneous vaccination of healthy cats 10 weeks of age or older, as an aid in the prevention of disease caused by feline leukemia virus. DOSE:Inject one 1 mL dose intramuscularly or subcutaneously using aseptic technique. Repeat in 3 to 4 weeks.

how much does gucci cost in china|Gucci cheap real